Blockchain: Disruptive Technology for the Energy Market

“The energy business has faced several fundamental obstacles in its continual quest to power the world, which has been addressed by the effective deployment of innovative and pioneering technology. The resulting industry environment is technologically advanced and well-organized, but it is beset by a complex and costly transactional ecology that could prove a fruitful ground for the adoption of distributed ledger technology.”

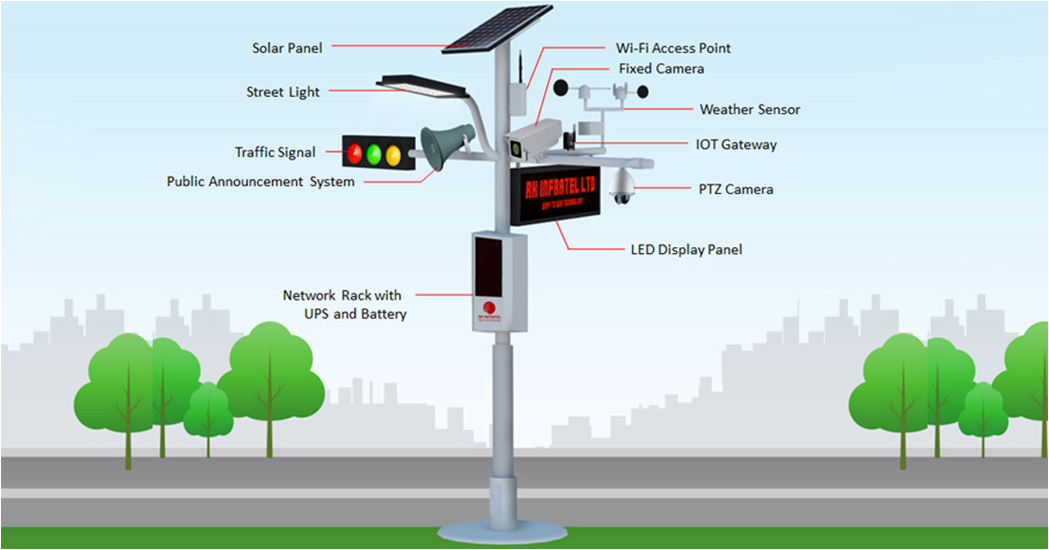

Executives must decide how to adopt many emerging digital innovations, including the Internet of Things (IoT), automation, artificial intelligence, cloud platforms, big data, and advanced analytics, with blockchain likely serving as the underlying backbone of the industry's transactional infrastructure.

Digital technology and omnipresent data are enabling wiser, more informed decisions and considerably enhanced operational efficiency by boosting visibility, transparency, coordination, and information sharing across business boundaries. However, in order to benefit from these digital advancements, the sector must solve the fundamental challenges of security and trust, which are fundamental business requirements.

History of Blockchain

Blockchain is a technology that was created to make cryptocurrency easier to use. It arose from a small group of developers' skepticism of the centralized banking system and traditional markets during the 2008 financial crisis. Long restricted to a small population in several nations throughout the world, its renown increased in 2017 as a result of the democratization and popularisation of cryptocurrencies, such as Bitcoin: according to the University of Cambridge, approximately 3 million people now own it.

What is Blockchain?

Blockchain is a technology for storing and sending information that is transparent, safe, and functions without a central review body, according to Blockchain France's definition.

A blockchain, by extension, is a database that contains the history of all transactions between its members since its inception. This database is both safe and distributed: it is shared by its many users in a decentralized way, without the use of intermediaries, allowing each user to verify the chain's validity.

The essential word here is "decentralized," because a blockchain creates a public, permanent, and unchangeable record whose coherence and integrity are maintained by network participants without the intervention of a central authority, servers, or trusted third parties. To put it another way, it does away with the necessity for a trusted third party to centralize all of the data.

All of this information is combined into a single file, which is then copied across all of the blockchain machines. The data record must be synchronized between all participants in order to maintain its immutability. The same information about the transactions must be available to all parties. The blockchain works on the premise of producing a temporary list of awaiting data (a block) and then utilizing a cryptographic verification mechanism to validate and share this list in a timely manner. This procedure is crucial to the technology's security. The new block is uploaded to the blockchain after it has been confirmed, and the process starts all over again.

How will Blockchain Benefit the Energy Industry?

The energy sector has the potential to be transformed by blockchain technology. Innovations such as rooftop solar, electric vehicles, and smart metering have continually stimulated the energy market. With its smart contracts and system interoperability, the Enterprise Ethereum blockchain now promotes itself as the next rising technology to spur growth in the energy sector. Energy and sustainability are two of the many use cases for blockchain that are often overlooked. However, a collaborative analysis from the World Economic Forum, Stanford Woods Institute for the Environment, and PwC identified more than 65 existing and emerging blockchain use-cases for the environment. New business models for energy markets, real-time data management, and transferring carbon credits or renewable energy certifications to the blockchain are among the use cases.

By tracking the chain of custody for grid items, distributed ledger technology has the potential to increase efficiencies for utility companies. Blockchain offers unique possibilities for renewable energy distribution in addition to provenance monitoring.

Enterprise Ethereum solutions have the potential to improve traditional energy sectors like oil and gas. Blockchain technology has the potential to improve complex systems with various actors. Petroleum, for example, is one of the most traded commodities and necessitates a complex network of refineries, tankers, jobbers, governments, and regulatory agencies. Siloed infrastructures and various process inefficiencies plague the complicated network of actors. Because of its ability to minimize costs and reduce adverse environmental impacts, large oil and gas conglomerates are looking to invest in and use blockchain technology.

Privacy and trade secrets are extremely important to oil and gas enterprises. Data permissions and selective consortium access to pre-approved parties are available on these private blockchain networks. Private and consortium blockchains serve as a stopgap until public blockchains are able to integrate the privacy features that businesses require.

The main benefits of blockchain in the energy sector are:

- Reduced costs

- Environmental sustainability

- Increased transparency for stakeholders while not compromising privacy

How does blockchain impact wholesale electricity distribution?

Companies interested in incorporating blockchain technology into wholesale electricity distribution concentrate on connecting end-users to the grid. Consumers may sell and buy energy directly from the grid, rather than from retailers, thanks to blockchain technology and IoT devices.

Grid+ is a blockchain-based energy firm that specializes in wholesale energy delivery. Retailers have been identified as the primary cause of inefficiencies in the consumer electricity market, according to the firm. The electrical infrastructure is largely owned by retailers. Instead, they solely handle the functions that blockchain technology can take over, such as billing and metering consumption.

Using a blockchain-based network to supplement businesses might save consumers up to 40% on their bills. Ethereum allows consumers to buy electricity from the grid at any price they choose because it connects them directly to the grid. As a result, the energy market is more egalitarian and stable, with lower electricity bills.

How does blockchain impact peer-to-peer energy trading?

While wholesale energy distribution is a significant application for many businesses, it is not the primary focus of all energy organizations. A peer-to-peer energy market is a community of people who trade and buy extra energy from one another. These energy marketplaces assist the general public by reducing central authority control, such as wholesale companies.

Enterprise versions of Ethereum are used by the majority of businesses. Renewable energy costs are becoming equivalent to or lower than traditional retail energy as more countries attain energy parity.

People that generate their own energy will be able to trade it with their friends and neighbors. Power Ledger, an Australian startup, has linked communities together to build "microgrids." A microgrid is a collection of interconnected loads and distributed energy sources. Microgrids currently exists as a layer on top of the national grid, although they can theoretically be self-contained and independent. Many blockchain energy firms envision a future in which peer-to-peer grids are larger and completely distributed.

How does blockchain impact electricity data management?

Consumers can benefit from improved efficiency and control over their energy sources thanks to blockchain technology. A safe and real-time updating of energy usage data is also provided by an immutable ledger. Market prices, marginal costs, energy law compliance, and fuel prices are all examples of different sorts of energy statistics. The Chilean National Energy Commission (CNE) started in April 2018 that it had initiated a blockchain-based energy project. The Ethereum blockchain will be used by the government department to record, store, and track energy data.

Data is frequently modified, either purposefully or unintentionally, and misreported and withheld. Intentional corruption and unintentional clerical errors can have a significant financial impact on corporations and governments. The CNE will make transaction and price records available to the public in the interest of openness. The transparency of public blockchains decreases the possibility of monetary or data exploitation even further.

How does blockchain impact utility providers?

Electric power companies are vast, sophisticated businesses that generate electricity from power plants, solar farms, and other sources. In comparison to financial services or the banking business, utility companies do not compete with one another. These companies are more eager to share data and information, creating a unique potential for blockchain's shared ledger.

Utility providers can benefit from distributed ledger technology in three ways, according to Greentech Media, a prominent renewable energy industry research organization. Enterprise At the grid edge, Ethereum can process and evaluate data from a large number of devices before securing it on the blockchain. Second, energy providers can use blockchain to construct a data-transfer infrastructure that is vital to distribution. Finally, distributed ledger technology can be utilized to create a mechanism for transferring energy among multiple parties.

Major Market Highlights:

- SAP SE purchased Emarsys eMarketing Systems. With the capabilities of its existing technologies and the convergence of Emarsys, SAP Consumer Service will provide a foundation for tailored omnichannel interaction, engaging consumers where and when they want to connect, on their preferred platforms, and under their terms.

- Infosys Limited purchased Blue Acorn iCi. This agreement would considerably improve Infosys' end-to-end client experience and reaffirm the company's commitment to assisting customers in their digitization journey. By merging consumer engagement, digital trading, research, and experience-driven commodities trading, Blue Acorn iCi will provide Infosys with critical cross-technology knowledge.

Conclusion

Through a process of lateral electrification, blockchain technology applied to energy could contribute to the growth of energy communities in industrialized countries and the electrification of locations where people do not yet have access to electricity. As a result, common technologies like blockchains bring together energy communities and lateral electrification.

The major goal is to make power purchases and sales more safe and transparent by removing direct monetary transactions. Other applications centered on electric vehicles and renewable energy production are also emerging. Nonetheless, key business model and regulatory system hurdles must be overcome first, particularly through the several pilot initiatives that are now underway. This is a requirement for the technology's large-scale development.